Being Gary

Before I get into what Gary doesn’t see, I want to start off by saying this:

I have a massive amount of respect for people like Gary.

Gary has an incredible ability to tolerate an endless onslaught of setbacks.

He’s got Grit. Determination. Resilience. Work ethic.

And he Doesn’t. Give. Up.

He’s a warrior. Certain to succeed in anything he sets his mind to.

Anything that is… except trading.

When I started “prop trading” there were three things on my mind:

1. I needed $1million in “funding”

2. 1% a month on $1m = $10K payout / month

3. I’ll run a professional ‘trading business’ within a year.

That was my entire focus.

I became a member of all the ‘gangs’ – each with a promise of their ‘system’ that would lead to funded riches.

– The ICT gang.

– SMC gang.

– Supply and Demand Gang.

– Gold Gang.

– Nasdaq Gang

– Fair Value Gap (FVG) Gang

– Unicorn Gang

Each had their “mentorship” that pulled me in a different direction. I wanted all the secret sauce from wherever I could get it.

The result?

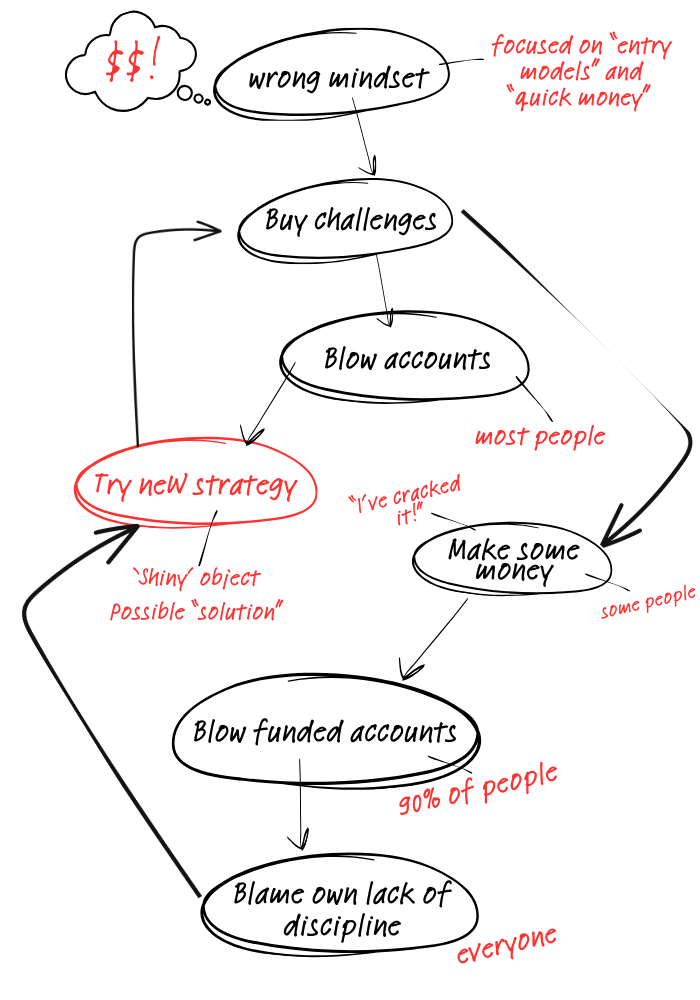

A year later: I was stuck in a “trading strategy” loop…

Blown challenge after blown challenge.

No trading business. No funding. Just a big hole in my already destroyed wallet.

And with every blown account the sense of failure began to grow inside me, until it started to reach a point of desperation.

Did I really suck this bad…?

I looked back at my trading. It was unrecognizable.

I was trading to ‘fix mistakes’. And in a state of constant panic about my P&L.

“Wins” provided temporary relief from tension…

But “losses” were a full blown identity crisis!

My flawed process looked like this:

At the first sign something wasn’t working, I was backtesting, tweaking , searching for the missing ‘fix’ that would make it all click.

Because, as a hardened ‘Gary’, I wasn’t into the blame game.

No sir! I took responsibility for my behaviour.

I knew I needed more discipline. So dammit – I was gonna make it happen!

I wrote out and refined my trading plan.

Started a ‘fresh trading journal’ (again!) . Even made it public for ‘accountability’.

I was gonna force myself to be a pro in the market.

I wrote my rules out on post-it notes and plastered them over my monitor.

“I WILL obey my trading rules.”

Maybe a daily cold shower to focus the mind…

Heck, I even hired a trading psychologist to observe me trade live and give me feedback… 👀

I tried it all. You name it – I did it.

(I suspect you know very well that none of it worked… )

In the end, no amount of forcing or engineering my external environment would produce the behaviour changes I wanted.

Rock bottom is a horrible place..

It sucks. The kind of suck that tears through your self esteem, cracks your confidence and breaks your belief in yourself.

I’d already been there once before in May of 2022 and dammit I was there again now.

It’s painful to even share this…

I remember blowing my ‘Lifeline’ funded account – the one where I said “this is the last one. No more.”

The reason?

Tilt...

…From an $11k “payout denial”.

Yeah… I’ll talk about those another time.

It hit so bad – that I ran to the back of the garden, behind the shed, where my wife and daughter couldn’t see me…

And I wept.

I uttered words to myself that I never thought I’d say.

“I can’t do this.”

But the thing about hitting rock bottom is: the only way left is up.

In a moment of desperation, I called my good friend, Michael, who happened to be an executive performance coach, and unloaded everything.

My doubts. Frustrations. And the fear that I wasn’t built for this.

He listened. Quietly.

And then he said something to me that changed everything.

“You’re trying to become more disciplined. That’s not gonna work.” He said.

“ You’ve got to be the kind of person, for whom discipline is effortless…”

That was it.

That one line.

…And right there, the penny dropped.

I realised I’d been seeing things all wrong.

I asked him what I needed to understand in order to become that person.

That conversation became the fork in the road – and the point where my trading journey started to change for the better…

Click here to continue… (Page 3 of 4)